Introduction

bloomberg for banks & financial institutions in 2025 : Taking data-driven decisions has become a necessity for banking and financial institutions in 2025. And many banks and financial institutions are using it. Bloomberg, a leading global financial data platform, provides advanced tools, real-time analytics and in-depth market intelligence to banks and institutions. In this blog, we will see how Bloomberg has become a game-changer for banks and financial sectors in 2025, with complete graphs, features, and FAQs.

Why Bloomberg is Essential for Banks in 2025

Real-Time Market Insights

Today, markets are changing at a rapid pace. Bloomberg Terminal provides real-time data, breaking financial news, and market sentiments, which helps banks take timely and informed decisions.

Risk Management & Compliance

Banks must follow compliance regulations such as Basel III, AML (Anti Money Laundering) and KYC. Bloomberg’s compliance suite provides analytics, monitoring tools and alerts to manage these regulations.

Credit Risk Assessment

Bloomberg’s credit risk dashboard gives banks a real-time overview of borrowers’ financial health. The tool tracks PD (probability of default), LGD (loss given default), and exposure metrics.

Proof & Example:

Bloomberg’s “Credit Risk Monitor” tool is used by global banks such as JP Morgan, HSBC to streamline loan underwriting.

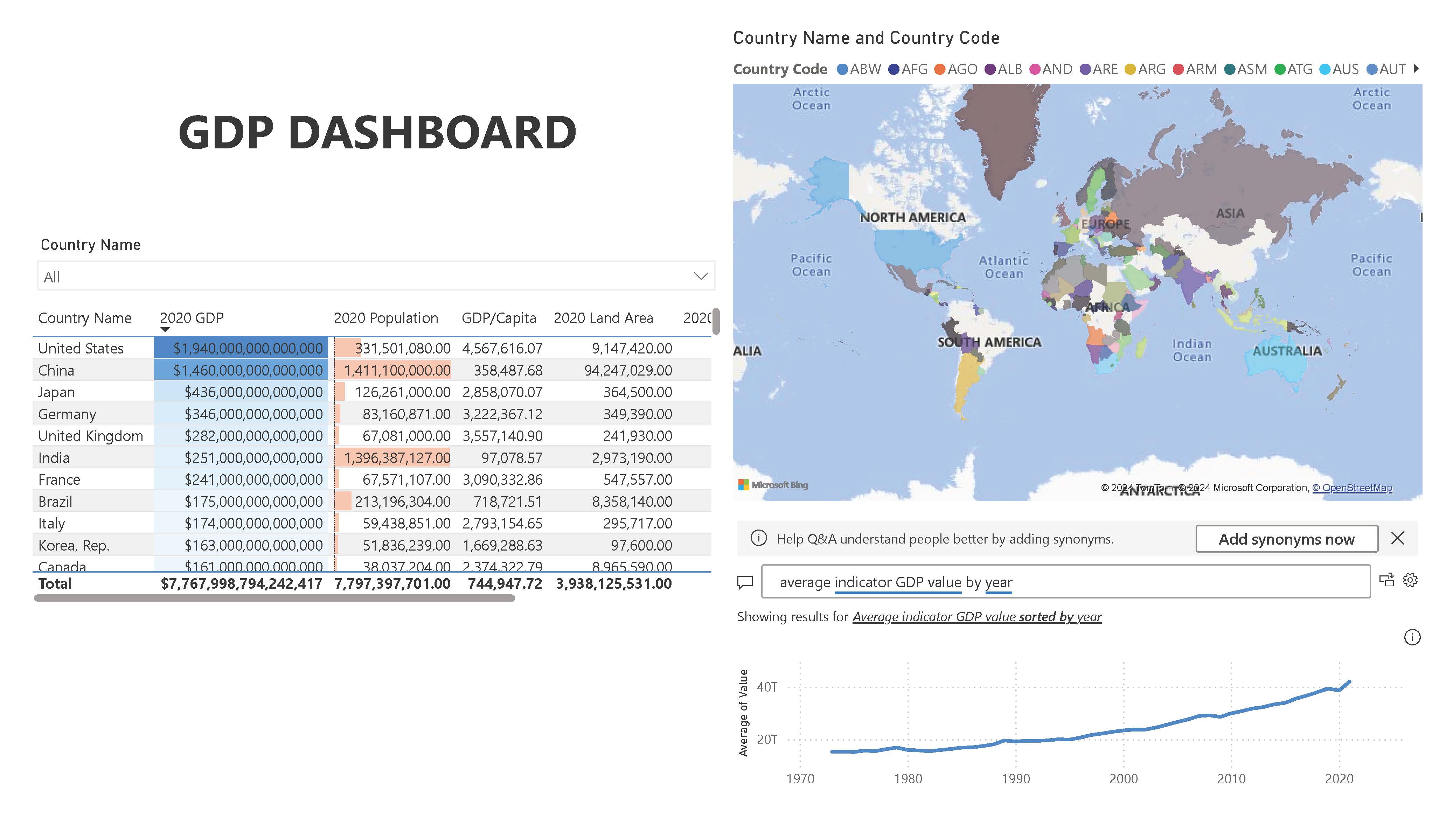

Global Economic Indicators

Banks need global indicators for macroeconomic forecasting. Bloomberg provides in-depth economic forecasting tools with IMF, World Bank, and proprietary indicators.

Key Features of Bloomberg for Banks

1. Bloomberg Terminal

An all-in-one solution that offers real-time news, analytics, financial models, and trading capabilities.

2. Bloomberg API (BLPAPI)

Banks can embed Bloomberg data into their internal systems such as CRMs, data lakes or compliance engines using these APIs.

3. ESG Dashboard

Environment, Social, and Governance (ESG) compliance is now a major banking requirement. Bloomberg’s ESG dashboard provides metrics for risk-aware lending.

4. Portfolio & Asset Management Tools

For the wealth management and investment banking wings, Bloomberg’s portfolio analytics system helps in performance tracking, risk analysis and rebalancing strategies.

Use Cases in Indian & Global Banks

Indian Banks:

- HDFC Bank: Uses Bloomberg analytics for credit scoring and FX desk management.

- SBI: Extracts real-time bond market data from Bloomberg Terminal for treasury decisions.

Global Banks:

- Goldman Sachs: Uses Bloomberg’s proprietary risk engine for derivatives desk.

- Citibank: Uses Bloomberg Regulatory Reporting suite for regulatory compliance.

- Graph: Bloomberg Terminal Adoption Growth (2020-2025)

Benefits for Financial Institutions

- Regulatory Compliance Automation

- Faster Decision-Making

- Real-Time Data Access

- Enhanced Customer Risk Profiling

- Integrated AI Forecasting Tools

Bloomberg vs Other Platforms (2025)

| Feature | Bloomberg | Refinitiv | S&P Global |

|---|---|---|---|

| Real-time Market Data | yes | yes | yes |

| ESG Tools | Advanced | Basic | Intermediate |

| API Access | Extensive | Limited | Moderate |

| Banking Compliance Tools | Complete | no | Limited |

Future of Bloomberg in Banking (2025 & Beyond)

- AI-Driven Insights: Bloomberg has integrated AI and ML for real-time risk alerts.

- Blockchain Integration: In the future, Bloomberg is bringing blockchain-based transaction monitoring tool.

- Digital Lending Support: Customized lending modules are available for Fintech and NBFCs.

Useful Links:

FAQs (People Also Ask)

Why do banks use Bloomberg?

Banks use Bloomberg for real-time data access, regulatory compliance, and financial risk management tools.

What is a Bloomberg Terminal & how does it work?

It is a premium software system that provides real-time information of financial markets, analytics tools, and trading interface.

What makes Bloomberg a great banking platform?

Bloomberg’s comprehensive data coverage, automation tools, and integration capabilities make it ideal.

Who uses Bloomberg Terminal in banks?

Traders, analysts, risk managers, compliance officers and portfolio managers use Bloomberg Terminal.

Does Bloomberg offer API or banking integration?

Now, Bloomberg’s BLPAPI system integrates with third-party systems and core banking platforms.

How has Bloomberg changed financial markets?

This platform has changed the data handling landscape of the poor financial industry by automating speed, accuracy and compliance.

Conclusion

In 2025, Bloomberg has announced a best tool for banks and financial institutions. Be it compliance, credit risk, or real-time market analysis — Bloomberg covers every aspect. If you work in the banking industry, adopting the Bloomberg Terminal and its features can take your decision-making and operational efficiency to the next level. And if you liked this blog, please share it with others.

1 thought on “bloomberg for banks & financial institutions in 2025”